The finance team within a business plays a pivotal role in managing its financial health and steering it towards growth and sustainability. To achieve this, the design and structure of the finance team are of paramount importance. In this article, we’ll delve into the critical aspects of finance team design and structure, focusing on how they can be optimized to enhance efficiency and drive growth.

Aligning with Organisational Goals

Leveraging Technology and Automation

Talent Development and Skill Enhancement

Testimonials

featured insights

Preparing your business for investment: An Overview

For many businesses, securing external investment can be crucial for driving growth and achieving long-term success. However, attracting investors is not just about having a great idea or product; it also requires careful preparation and planning. This guide provides practical advice on how to get your business investment-ready.

Read More

Decoding Business Performance: The Value of Diagnostic Financial Reviews for SME’s

Small and medium-sized enterprises (SMEs) make up a significant portion of most economies worldwide, serving as vital engines of job creation, innovation, and economic dynamism. However, these businesses often face unique challenges that require specialized solutions, one of which is understanding and improving their financial performance.

Read More

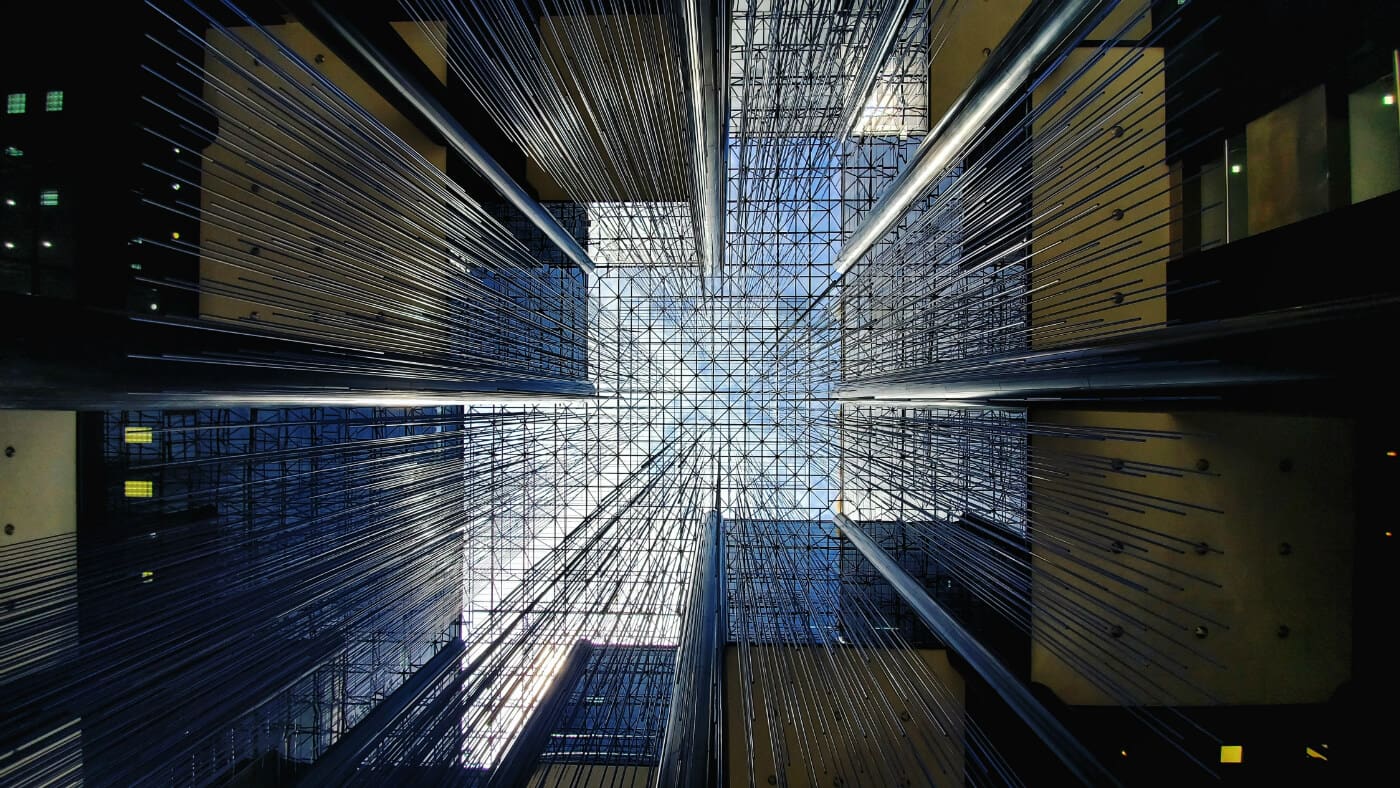

Digital Transformation: Navigating the Journey towards Enhanced Productivity

In today’s dynamic business landscape, digital transformation is no longer just a buzzword; it’s a strategic imperative. Small and medium-sized enterprises (SMEs) are increasingly recognising the potential of digital transformation to drive efficiency, competitiveness, and growth. In this article, we will explore the concept of digital transformation and offer insights on how managers in SMEs can navigate this transformative journey to enhance produc

Read More